Real Luck Group Ltd made the debut on Toronto’s TSX Venture Exchange (TSXV) under the code called “LUCK”.

CEO Quentin Martin told Esports Insider earlier this month the e-sports betting company is aiming to close its market cap of C $ 28.2 million (~ £ 16.2 million). The company hopes [the number] can go up, he added. They believe They are priced Theyll compared to competitors in the industry. ”

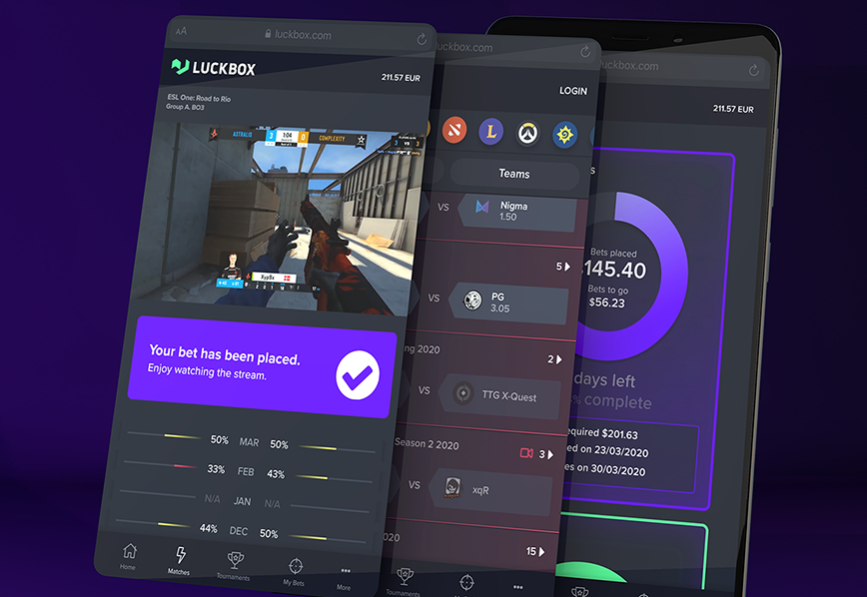

Luckbox has grown 500% by 2020, making the most of the purple segment for the e-sports betting industry. “Lockdown is really driving esports betting for years to come,” Martin told Esports Insider. “It’s certainly been a period of super fast growth.” Martin also claimed Luckbox had withheld 75 percent of profits from new customers during the COVID-induced global shutdown.

These were exciting times and 2021 would be a very busy year for them, Martin said. So far, almost all of their growth had been organic and the growth potential through marketing was enormous.

In June of this year, Luckbox ended its investment round with a total value of 3.8 million CAD (~ 2.2 million pounds). A month later, the company raised an additional C $ 5 million (~ £ 2.9 million), including sponsorship from Major League Soccer player Luis Robles.

Despite being based in the Isle of Man, the company will still list in Canada on TSXV as it has developed a strong network of domestic investors. According to a statement from the company, the listing comes just 20 months after Luckbox accepted its first bet. The company was established in 2016.

While many esports teams and tournament organizers struggle to make money, esports betting companies remain unharmed before the global pandemic, said Esports Insider. Luckbox is one of the very few betting companies dedicated to esports that has listed a share. Don’t be surprised to see more numbers in the coming years.